Please read my disclosure policy for more info. I may earn money from the companies mentioned in this post with no additional cost to you. If nothing else, then you should get some clarity around where your money is going each paycheck (and that's golden!).This article may contain affiliate links. How are you budgeting currently? How do you think using a budget by paycheck worksheet is going to change things for you? I can't wait to see your results.

#FREE PRINTABLE BUDGET SHEET FREE#

Here are some free sinking fund tracker printables. Make a list of larger expenses you’d like to spread out over the course of several months or even a year, and put that as a line item in your paycheck budgeting worksheets. That’s because if you don’t, then that month you’ll be stuck with no extra money to spend, or you’ll have to take from your savings/emergency fund.

#FREE PRINTABLE BUDGET SHEET HOW TO#

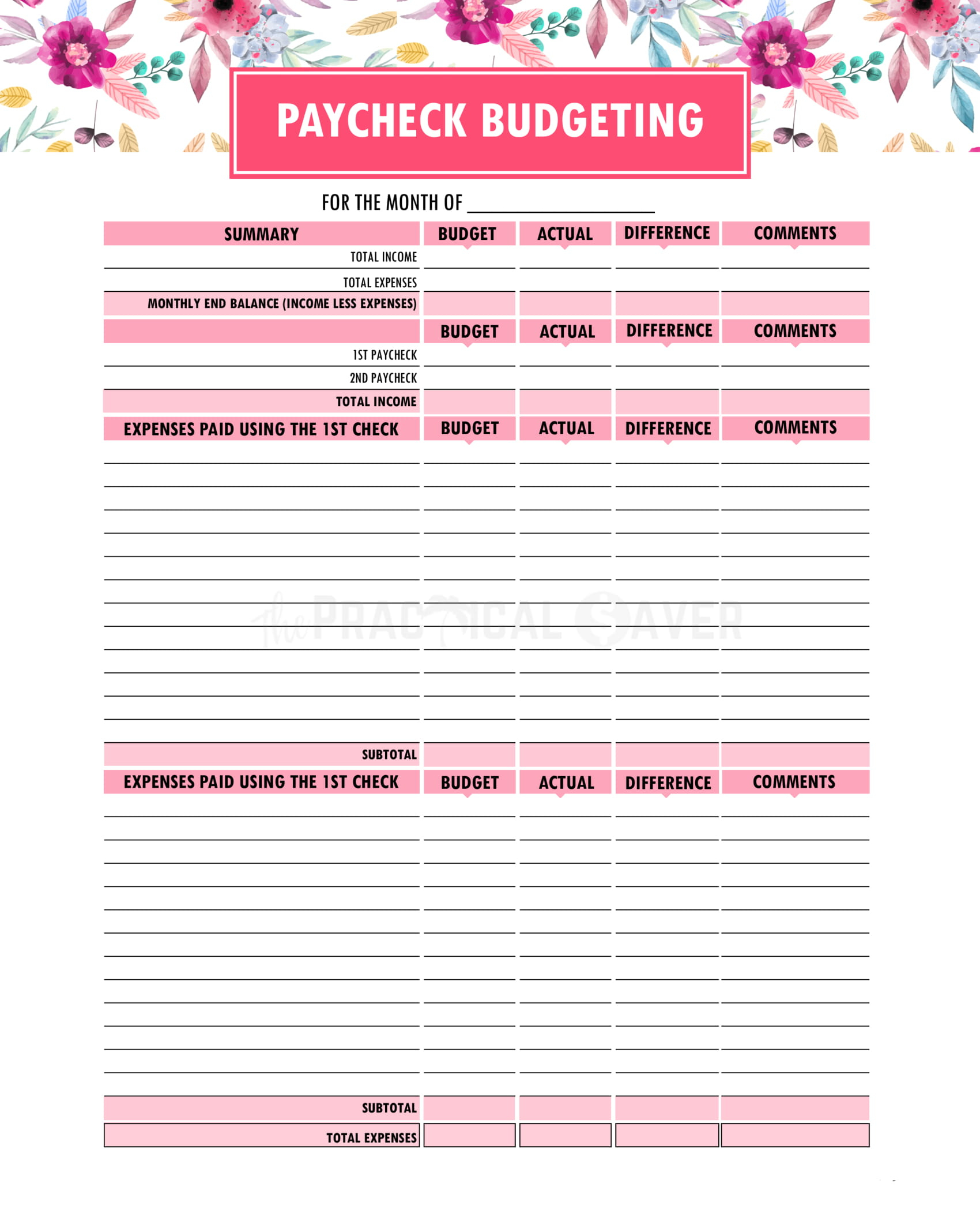

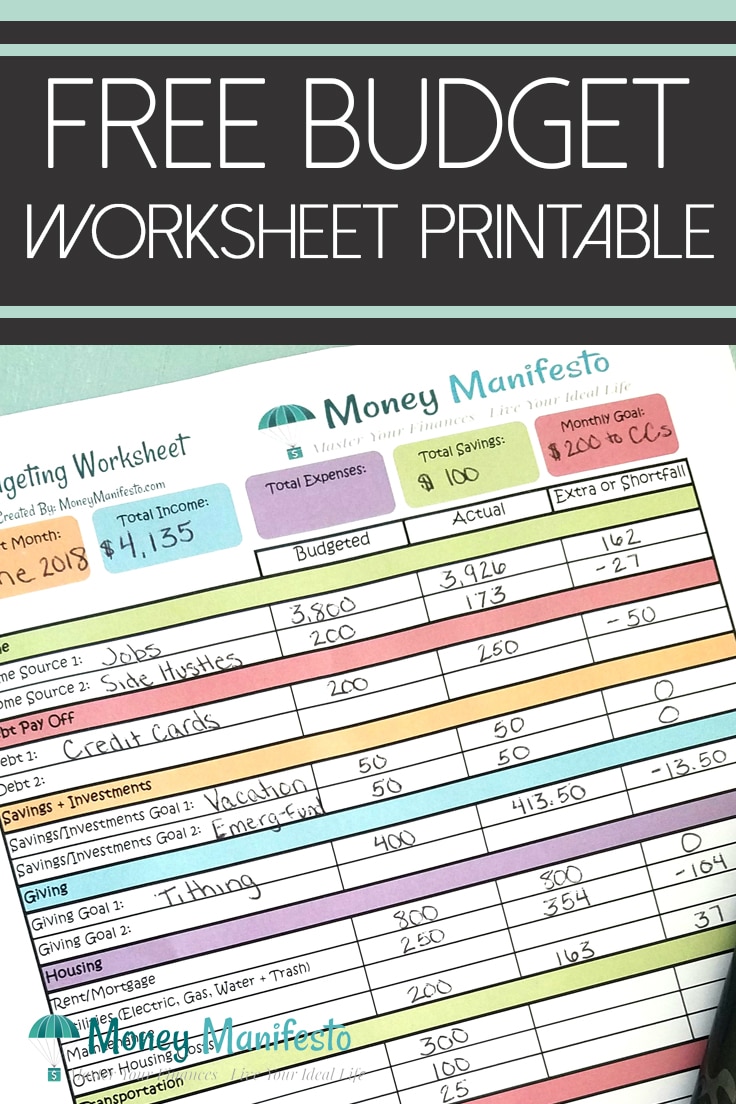

How Do You Calculate a Budget for a Paycheck?įor each paycheck that you get this month (and throughout the year, if you decide to stick with this personal budgeting method), you’ll need a paycheck budget worksheet. Going through this process – planning your budget by paycheck, then writing in what actually happened, and subtracting the two to finding your “leaks and leftovers” – will definitely build your budget-making skills. Here’s a set of simple Paycheck Budgeting printables – what I like about them is that there’s a spot for what you budgeted, then what actually happened, and the difference between the two.

MintNotion’s Paycheck Budgeting Printable Hint: these can be really helpful when figuring out how to transition from credit card to cash. Punch some holes, stick them in a binder, and you now have a budgeting station. So, choose one of the following budget by paycheck worksheets, then set yourself up for success by printing out enough for at least six months. I find that organizing and prepping things ahead of time is half the battle, personally. Free Budget by Paycheck Worksheets (PDFs) Let’s dive into the free resources, and then keep reading to learn more about how to budget by paycheck so that you can make the most of them. Whether that’s paying down your debt faster, saving up money, investing in yourself to get that promotion or work towards getting into the career of your choice, or even to be able to live a different lifestyle than what you’re currently experiencing. Rather, these worksheets are here to help with both having enough money to get to the next paycheck AND to get ahead financially because you'll be controlling your money better. Remember that even though using these worksheets will definitely have you thinking about your money on a paycheck basis, the goal isn't to reinforce living paycheck to paycheck lifestyle. That’s because weekly budgeting can get dicey when you have paychecks in some weeks but not others, and the rent or mortgage bill soaks up all the funds in a single week.Īnd monthly budgeting can often be too long an amount of time to change or guide your daily money decisions (though it can be great for a more holistic picture of your money).

0 kommentar(er)

0 kommentar(er)